National Pension System

Building Your Retirement Future

Planning for retirement often takes a backseat in our busy financial lives, until it suddenly becomes urgent. As life expectancy rises and traditional pension systems fade, building a secure, self-funded retirement corpus has never been more important. This is where the National Pension System (NPS) steps in a government-backed, market-linked savings scheme designed to help every Indian achieve long-term financial independence.

With one of the lowest fund management costs globally, flexible investment choices, and generous tax benefits, NPS has evolved from a government employee plan into a powerful retirement solution for all citizens -salaried, self-employed, and even gig workers.

In this post, we’ll explore how NPS works, its account types (Tier I, II & III), the recent reforms making it more investor-friendly, and why it deserves a place in your financial portfolio.

1. What is NPS?

The National Pension System (NPS) is a voluntary, defined-contribution retirement savings scheme regulated by PFRDA. It allows individuals to build a retirement corpus by contributing regularly, which is then invested in equity, debt, and government securities. It was launched for government employees in 2004 and opened to all citizens in 2009.

NPS is among the lowest-cost retirement products globally (fund management fee 0.01–0.09%) and offers attractive tax benefits, making it a key tool for long-term financial planning.

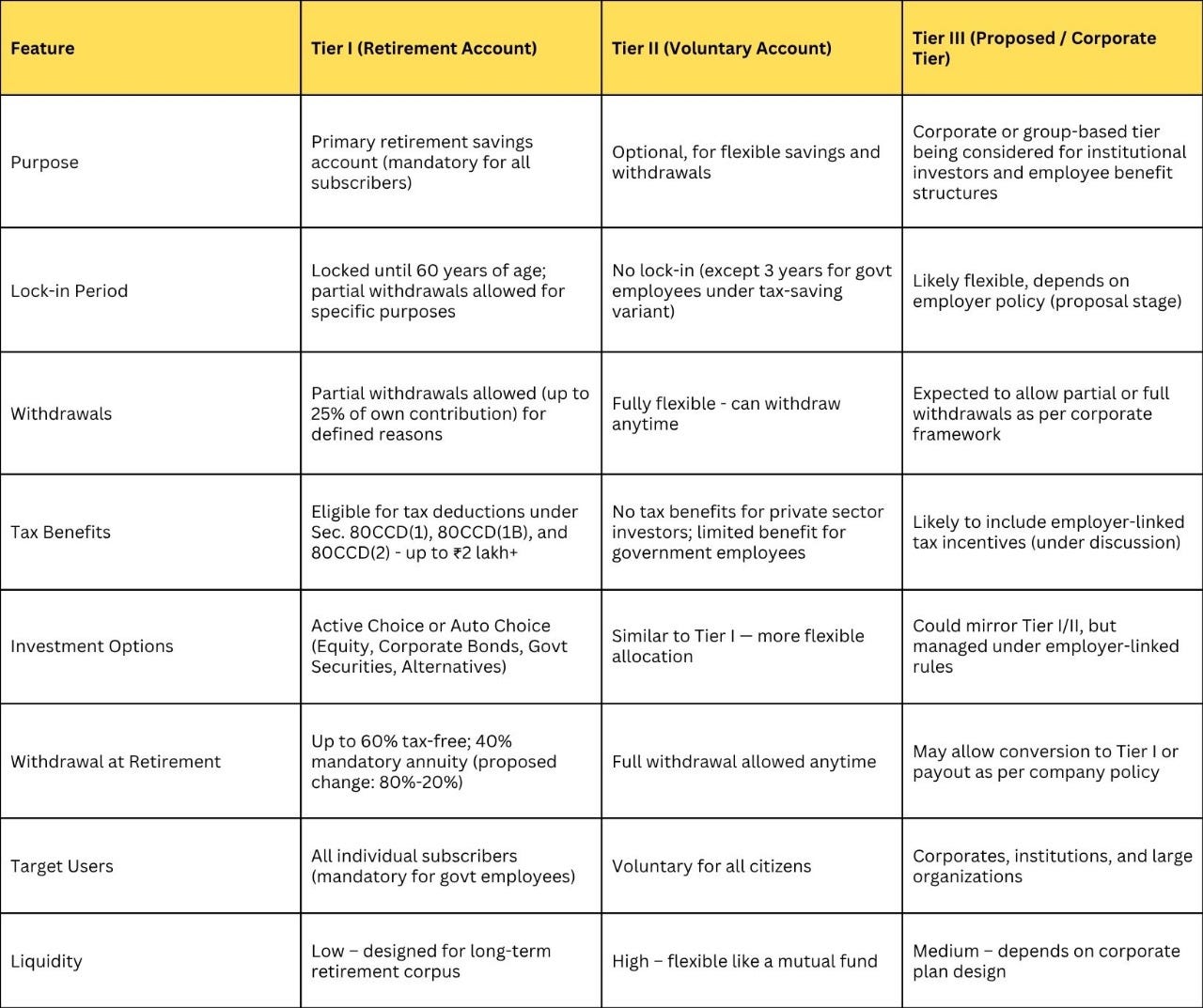

2. Account Types

3. Recent Changes (Effective Oct 2025)

PFRDA has proposed reforms to make NPS more flexible and competitive:

Multiple Scheme Framework (MSF): Investors can hold multiple schemes under one PRAN, including variants with up to 100% equity.

Lower Annuity Requirement: Mandatory annuitisation may reduce from 40% to 20%, allowing 80% lump-sum withdrawal.

Early Exit & Higher Partial Withdrawals: Exit option after 15 years and more withdrawal flexibility.

Credit Facilities Against PRAN: Loan-like facilities being explored without breaking compounding.

Standardised Disclosure: More transparency in charges and scheme comparison.

Benefit: Greater choice, flexibility, and liquidity for investors.

4. Risks & Considerations

Market Risk: High equity allocation can lead to volatility and retirement corpus fluctuation.

Sequence-of-Returns Risk: A market crash before retirement can permanently reduce annuity income.

Longevity Risk: Lower annuitisation means higher freedom but also risk of outliving savings.

Behavioural Risk: Large lump sums may tempt overspending.

Taxation: Annuity income is taxable as per slab.

5. Case Study – NPS in Action

Rajesh, a 30-year-old salaried employee who is looking to build a secure retirement corpus. Rajesh decides to invest ₹6,000 every month (₹72,000 annually) in his Tier-I NPS account, choosing the LC75 (Aggressive Life-Cycle Fund). This option allocates a higher proportion of his savings to equity in the early years and gradually reduces exposure as he grows older, which helps him benefit from long-term equity growth.

Over a period of 30 years, assuming an average return of 10% per annum, Rajesh’s contributions build up to a retirement corpus of approximately ₹1.36 crore by the time he turns 60.

Under the current rules, Rajesh can withdraw up to 60% of his corpus tax-free as a lump sum. This means he would be able to take out nearly ₹81 lakh at retirement, which can be used for major expenses such as purchasing a home, children’s education, or reinvestment. The remaining 40% of the corpus (about ₹54 lakh) must be used to purchase an annuity plan, which will provide him with a regular pension. Based on prevailing annuity rates, Rajesh could expect an income of roughly ₹3.2–3.5 lakh per year, giving him financial stability in his post-retirement years.

However, under the proposed reforms, the mandatory annuitisation may be reduced from 40% to 20%. In this case, Rajesh would have the option to withdraw up to 80% of his corpus (about ₹1.08 crore) as a lump sum, while only ₹27 lakh would go into an annuity. This change would give Rajesh far greater liquidity at retirement, allowing him to use the bulk of his savings for medical expenses, lifestyle needs, or alternative investments. At the same time, it would also mean a smaller pension income from annuity, requiring him to carefully plan how to manage and reinvest his lump sum so that it lasts throughout retirement.

This example shows how NPS not only helps individuals accumulate a sizeable retirement corpus but also highlights the importance of understanding withdrawal rules and planning for both liquidity and long-term income security.

6. Why Should You Consider NPS?

Tax-efficient: Extra ₹50,000 deduction under 80CCD(1B) beyond Section 80C.

Low cost, high compounding: Minimal fund management charges.

Flexible investing: Active or auto allocation.

Reforms increase attractiveness: Higher liquidity, multiple schemes, and customisation for professionals, gig workers, and corporates.

In short: NPS is best suited for long-term retirement planning, combining tax savings, compounding, and regulated safety – but requires disciplined use of withdrawals and annuity planning.